As Ireland's economy continues to evolve in a post-pandemic world, businesses face the critical challenge of developing compensation strategies that balance employee retention with financial sustainability. With inflation showing signs of moderation but wage growth remaining robust, organizations need a data-driven approach to salary planning for 2026. This analysis provides evidence-based recommendations to help Irish employers navigate this complex landscape.

Ireland's inflation rate has reached 2.7% as of September 2025, representing an 18-month high according to the Central Statistics Office (CSO). This marks a significant acceleration from the low of 0.7% observed in September/October 2024. The current inflationary environment is primarily driven by rising food and non-alcoholic beverage prices, which have increased by 4.7% year-over-year.

Specific food categories have seen particularly dramatic price increases, with beef and veal prices surging by 23.7% since September 2024, while whole milk and low-fat milk have increased by 12.1% and 13.5% respectively. These substantial increases in essential goods are placing significant pressure on household budgets, especially for lower-income employees.

Core inflation, which excludes volatile energy and unprocessed food prices, stands at 2.8% – slightly higher than the headline rate. This indicates that price pressures are becoming more broadly based throughout the economy rather than being driven by a few volatile categories.

Looking ahead, there are encouraging signs that inflation pressures will moderate. The Central Bank of Ireland's Q3 2025 Quarterly Bulletin projects headline inflation to stand at 1.8% for 2025, before declining further to 1.4% in 2026. These projections are based on several key assumptions, including continued services price pressures being offset by moderating goods inflation, gradual normalization of price pressures, and stable energy markets.

The European Central Bank (ECB) offers a slightly more conservative outlook, with projections of 2.1% for 2025 and 1.7% for 2026. While these figures differ slightly from the Central Bank of Ireland's forecasts, both institutions agree on the overall downward trajectory of inflation over the next 12-18 months.

This projected moderation in inflation provides an important context for salary planning. While current inflation remains elevated, the expected decline suggests that employers need not build in excessive inflation protection for the entirety of 2026.

Despite the anticipated moderation in inflation, wage growth in Ireland remains robust. According to the CSO, average weekly earnings reached €1,026.20 in Q1 2025, representing a 5.6% increase from €972.20 in Q1 2024. This marks the first time that average weekly earnings have surpassed €1,000 since the CSO began tracking this metric in 2008.

Average hourly earnings have shown even stronger growth, increasing by 5.9% year-over-year to €31.72 in Q1 2025. Over the five-year period from Q1 2020 to Q1 2025, average hourly earnings have risen by an impressive 28.1%.

The Irish Business and Employers Confederation (IBEC) Pay Trends Report provides additional context on employer actions and intentions. According to their survey of over 400 Senior HR Professionals:

These figures indicate a gradual moderation in wage growth from the elevated levels seen in 2024, but still represent significant increases well above projected inflation rates.

Sectoral variations are notable, with manufacturing planning higher increases (5.47%) compared to services (3.76%). Tourism and retail saw the largest pay increases in 2024, reflecting changes in the minimum wage.

A significant factor influencing salary planning for 2026 is the upcoming increase in Ireland's national minimum wage. As announced in Budget 2026, the minimum wage will increase from €13.50 to €14.15 per hour effective January 1, 2026. This represents a 4.8% increase and will have ripple effects throughout organizational salary structures.

The minimum wage increase creates particular challenges for employers with a high proportion of lower-paid workers, as it can lead to compression in salary differentials between entry-level and more experienced staff. Without careful planning, this compression can undermine internal equity and create retention risks among employees with greater experience or responsibility.

The impact will be most pronounced in sectors with higher proportions of minimum wage workers, such as retail, hospitality, and tourism. However, all organizations need to consider how this change affects their overall salary structure and differentials between pay grades.

Based on comprehensive analysis of verified economic data, we recommend a salary increase range of 3.0% - 4.0% for 2026. This recommendation is founded on three key principles:

As the chart above illustrates, our recommended salary increases for 2026 maintain a healthy buffer above projected inflation rates, ensuring employees' purchasing power is protected while also reflecting the gradual moderation in overall wage growth across the Irish economy.

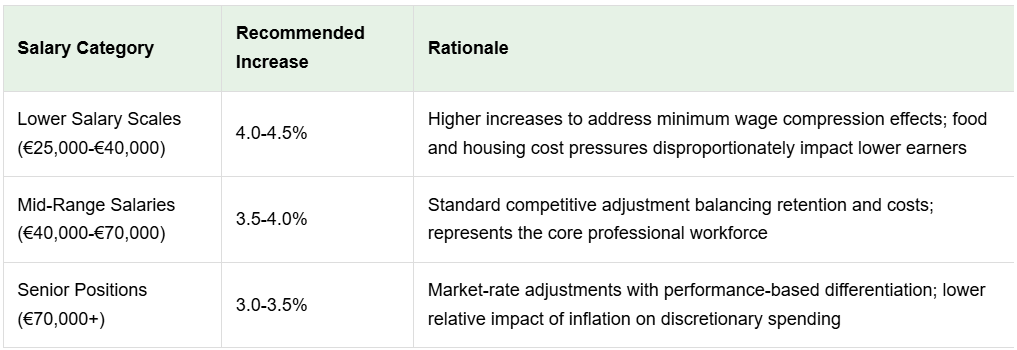

To address the varying impacts of inflation and minimum wage changes across different salary levels, we recommend a tiered approach to salary increases:

This progressive approach recognizes that inflation impacts employees differently based on their income level, with lower-paid workers typically spending a higher proportion of their income on essentials like food and housing, which have seen some of the largest price increases.

We recommend implementing salary increases in January 2026 to align with the minimum wage changes and typical budget cycles. This timing allows organizations to incorporate the new minimum wage requirements while making broader adjustments to maintain appropriate differentials throughout the salary structure.

A quarterly review mechanism should be established to monitor inflation developments and competitive positioning throughout the year. This allows for potential mid-year adjustments if economic conditions change significantly.

Several risk factors could impact the effectiveness of the recommended salary strategy:

Organizations should maintain flexibility to respond to these risks as they evolve throughout 2026.

To implement the recommended increases while managing overall compensation costs, consider the following strategies:

While the general recommendation applies across industries, certain sectors may need to adjust their approach:

The recommended 3.0-4.0% salary increase range for 2026 provides a balanced approach that protects employee purchasing power against inflation, maintains competitive positioning in the Irish market, supports retention during continued talent market tightness, and remains financially sustainable during economic normalization.

By implementing a tiered approach that provides higher percentage increases to lower-paid employees, organizations can address the compression effects of minimum wage increases while maintaining appropriate differentials throughout their salary structure.

This strategy positions organizations to navigate the transition from the elevated inflation environment of 2024-2025 while maintaining workforce stability and competitive advantage in the Irish market.

At M.A. Whately, we help businesses develop and implement effective compensation strategies that balance employee retention with financial sustainability. Contact us today to discuss how we can help you navigate the complex compensation landscape for 2026.

Book a Quick Chat | Contact Us